How Much Does a Fee-Only Financial Advisor Cost?

It should be a simple enough question: how much will it cost you to get comprehensive financial planning and personalized investment advice? You wouldn't go to a mechanic or a hairstylist without some idea of how much it would cost you beforehand. Nor should you with your finances.

Although financial planners have grown in popularity, not much is published about how much personal finance advisors charge for their services. An alarming amount of investors don't know how much they currently pay for their investment management services. Do you?

According to a 2017 Harris Poll study on behalf of Personal Capital, only 39% of those surveyed agreed with the statement, "I know the amount of fees I pay on all of my investment accounts." Many investors didn't even know whether they were paying fees on their mutual funds, EFTs, or financial planning at all!

If you're considering engaging a financial advisor and are unsure about how much you pay overall for their services, you should always ask. And if you're already working with someone who doesn't itemize their fees, you might want to reconsider it now! There may be costs involved if you switch to a Fee-Only advisor, but you still benefit in the long run.

What to Look for in Financial Advisor Charges

Wouldn't it be fantastic if everyone who called themselves a financial advisor was required to advertise the expenses they charge upfront? Unfortunately, that's never going to happen! It's just not how the U.S. industry works. The reality is that – to some degree – it is usually up to the client to inquire about a financial advisor's fees.

That's why we've provided helpful guides on how to select a financial planner - and what you need to watch out for with commission-based advisors who don't operate on a Fee-Only structure. Remember, fee-based advisors are often paid by commission, so you should ask how much they're getting in total for all the services and investments. They may not have your best interests in mind when they try to sell life insurance or other financial products that they receive kickbacks on.

Thankfully, fiduciaries – or Fee-Only planners like us – are required by to disclose all fees and identify any conflicts of interest - if there are any (which is unlikely!)

It's all public knowledge if you know where to look. You can jump below to see each financial advisor's fee structure at Phoenix Fee-Only. We believe it's important our clients have a clear understanding of exactly how much they can expect to pay for financial advice in advance.

Here are some questions to ask prospective financial advisors about how they're paid:

Any potential financial advisors that you research should give clear and straightforward answers to all of these questions. And at Phoenix Fee-Only, we're happy to answer any additional questions you might have because our clients' best interests are always the number one priority.

- How are you compensated?

- Are you Commission, Fee-Based, or Fee-Only?

- Do you always act as a fiduciary to all of your clients?

- Are you a certified financial planner?

- What are your specializations?

- What's your background/experience working with clients like me?

- Do you only offer investment advice? What topics can we discuss?

- How do I pay for your advisor fees?

- Can you just charge fees for advice?

- What are my total costs for working with you?

- Do I need to transfer assets to you or invest money?

- Can you implement investments for me, or only advise?

- Will you help me develop a comprehensive financial plan with reviews of my cash flow, savings, tax planning, insurance coverage, retirement goals, and estate plans?

- Do you offer ongoing services?

- What will I find when I look you up through regulators like FINRA BrokerCheck and Investor.gov)?

How Fee-Only Financial Advisors are Different

Fee-Only advisors are required to explain exactly how we charge. This professional transparency includes how much we bill, along with how and when you pay — plus those charges need to be clearly visible, so you know exactly what you've paid for. There are no hidden surprises.

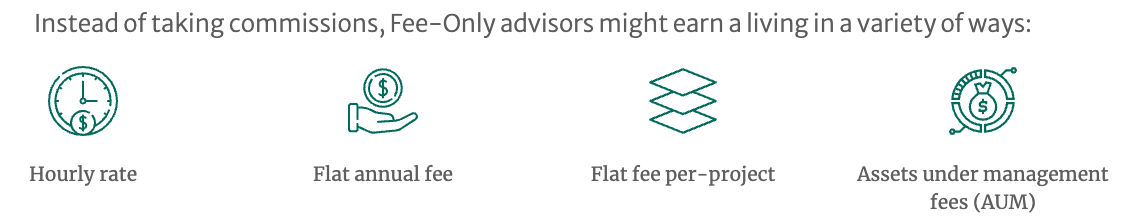

On the surface, Fee-Only advisors aren't necessarily less expensive than commissioned ones. But our income is not influenced by how you invest cash, what investments you purchase, or if you buy insurance from us - unlike many financial advisors who work on commission from insurance companies and other third parties. So you never have to worry whether what you're being sold is just in pursuit of sales-based compensation, kickbacks, referral fees, or dubious "bonuses". It's not allowed, and it's not what we do.

What You're Paying For With a Fee-Only Financial Advisor

When you pay Fee-Only planners for advice, we simply provide what we know is the best advice for your situation. The idea behind our fees is to charge for doing the work you want performed. And our prices are directly linked to the value you receive.

Rather than solely setting the price based on its time-and-labour, most financial advisors charge based on how much money they manage for you. That fee can range from 0.25% to 1.5% per year. Some financial advisors charge a flat hourly or annual fee instead.

Fee-Only Financial Advisors' Costs

Generally, flat fees for financial advisors range between $1K to $20K/yr based on your situation. In comparison, those who charge a percentage on the amount of your account balance will typically start at 1% for accounts under $1M (this rate often decreases as you have more money under management).

A client with assets of $100,000 may be paying $1,000 per year, whereas an investor who has $1,000,000 in investments might see themselves spending between $7,500-$12,500 per calendar year! In other words, those who have more money to manage usually pay a greater amount for their financial plan, although this percentage decreases above certain thresholds (typically after the first $1M under management).

All that said, fees are varied. Some charge flat fees for completing projects or one-time financial plans, although they typically also have specialized expertise. Advisors might also set their pricing based on complexity – so your circumstances and the types of investment advice that you require (rather than your bank balance) will ultimately determine the costs.

What You Get From a Fee-Only Financial Advisor

Our fee structures are reasonable relative to our Fee-Only peers and compared to our competitors' costs. If you're only getting investment management - someone who will pick your investments for you and reallocate them occasionally - then 1% is high. But if you're getting ongoing comprehensive financial planning, it's well worth the price.

The advisor should also meet with you regularly to update the plan and be available for any questions you might have. Additionally, as you near retirement age, the planner can advise you on crucial decisions - such as when to apply for Social Security, which Medicare coverage is the best, and when it's time to utilize your savings in your golden years.

Contact us here if you're interested in finding out more about how much it can benefit you to work with Phoenix Fee-Only. We have a wide range of services and specializations; please also view our fee structure below.

Our Fee Structures

Each member of Phoenix Fee-Only has a slightly different offering. The actual pricing of the investment advisory services and financial planning services is calculated differently by each advisor. This means that you can choose which suits your lifestyle best from a variety of options.

- Heather Townsend is a CFP® and CPA specializing in business owners and high-net-worth individuals. Heather's Ongoing Wealth Management Fee starts at $20,000.

- Andrea Clark CFP® is also an Accredited Financial Counselor. She charges an annual planning fee of $2.4K - $4K, paid on a monthly subscription basis. Small business owners who need to implement a 401k pay a $1000 set-up fee plus an ongoing 0.50% on assets within the plan.

- Robinson Crawford is a CFP® with experience in wealth management. His fees are $400/hr, and $2.4K/year for ongoing planning. Robinson charges 1.2% for Ongoing Wealth Management Fee below $1M; 0.8% between $1M-$5M; and 0.4% for $5M+.

- Stephen Hazel has CFP® accreditation and is a senior-level executive, with extensive experience in financial administration and accounting. He charges $4K per financial plan, and $250-$5K for tax return preparation and filing. Stephen's annual fees are $5K-$30K/year. For investment only options, he charges 1.5% for the first $250K with a sliding scale on amounts above this.

- Dan VanDusen, CFP® has experience in wealth management, retirement, and tax planning. His fees start at 0.9% of assets up to $1MM, 0.5% until $5MM, and 0.3% thereafter. For those without investment management, he charges a planning fee starting at $3,600/year. For clients, he also prepares tax returns starting at $350.

- Anthony Syracuse, CFP® specializes in working with dual-income clients that have growing families, and those working in the technology industry. His services start at $5,000 for a one-time engagement, and ongoing services can be paid for hourly, monthly or quarterly, starting at $450/hr. He also manages investments for clients, with costs for this starting at 0.9% and reducing as investment balances increase.

- Dale Shafer, CFP® flat fee based on financial complexity (min $3,600/yr), can be paid through AUM or AdvicePay and is charged on a monthly basis. Investment management is included for most clients, but investments only are available on request and billed starting a 1.25% <$500,000.

- Francisco Ayala, CFP®, CFA, MBA Financial Planning only: Singles Year 1 $4,200, Years 2+ $3,420. Couples Year 1 $5,100, Years 2+ $4,200. We do IM for $1,200/yr, no asset minimums. Fees paid monthly.

- Matthew Benson, CFP® Assets Under Management minimum of $500k, bill 1.25% below $1MM, and 1% above $1 MM. retirees or pre-retirees in Chandler, Gilbert, Mesa, and Queen Creek.