As we inch closer to the second half of 2024, I'll give you three reasons to be optimistic about the financial markets' outlook.

We have an election on the horizon, so you'll likely hear mixed messages about the economy's future over the next several months. As you hear from the naysayers, please keep these three trends in mind.

Earnings growth is accelerating. Standard & Poor's 500 companies have posted a 5.4% growth rate for Q1 (92% of companies have reported). That's the highest since Q2 2022. Looking ahead, analysts expect year-over-year growth rates of 9.6% in Q2, 8.4% in Q3 and 17.1% in Q4.1,2

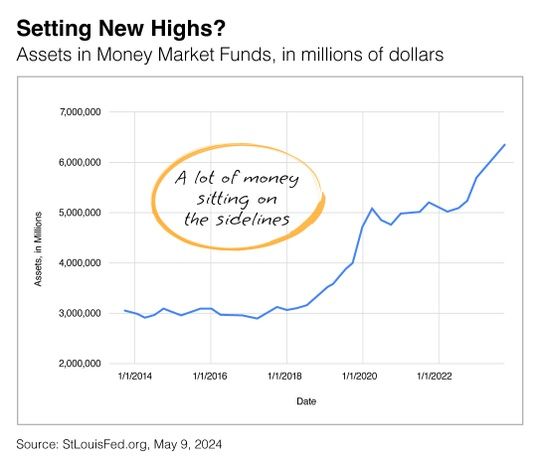

There's $6 trillion in cash on the sidelines. Cash in money market mutual funds approached $6.4 trillion in late 2023 (through October, the latest figure available). As you can see in the chart below, money market fund assets have doubled since 2018. The funds may have dipped in recent months, but much money may still be on the sidelines.3,4

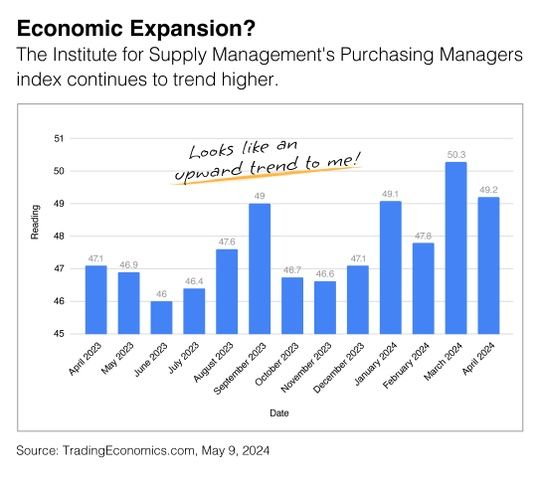

Economic activity is picking up. Activity in the manufacturing sector is trending higher. As you can see in the accompanying chart, the Manufacturing Purchasing Managers Index dipped slightly in April 2024 but has been tending higher for the past year. While some believe a reading above 50 indicates economic activity is picking up, ISM says a PMI above 42.5%, over some time, generally indicates an expansion of the overall economy.5,6

The economy is never perfect, and as the second half unfolds, you'll likely hear many professionals pick it apart, saying, "It's not doing this," or "It's not doing enough of that."

But based on these three indicators, I'm upbeat about what lies ahead. If you have a favorite indicator, please let me know. My next update might have another chart or two!

1. Advantage.FactSet.com, May 10, 2024. "Earnings Insight."

2. The forecasts or forward-looking statements are based on assumptions, subject to revision without notice, and may not materialize.

3. Fred.StLouis.org, May 9, 2024. The chart is updated four times a year. The last update was in October 2023.

4. Money held in money market funds is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Money market funds seek to preserve the value of your investment at $1.00 a share. However, it is possible to lose money by investing in a money market fund.

Money market mutual funds are sold by prospectus. Please carefully consider the charges, risks, expenses, and investment objectives before investing. A prospectus containing this and other information about the investment company can be obtained from your financial professional. Please read it carefully before you invest or send money.

5. TradingEconomics.com, May 9, 2024. “United States ISM Manufacturing PMI.”

6. InstituteforSupplyManagement.org, 2024.