A quality education can be critical to your child's or grandchild's success, but it comes at a cost. And at the end of the day, the benefits of that education, both tangible and intangible, must outweigh the costs.

If you live in Arizona, this guide will help you better understand the costs associated with higher education in the Grand Canyon State and how to make an informed decision about financing your child’s or grandchild’s college experience or helping them navigate the journey on their own.

Understanding Higher Education Costs in Arizona

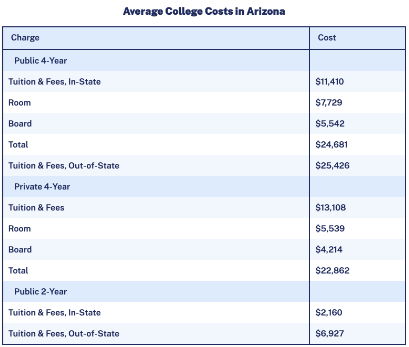

In Arizona, like the rest of the US, the cost of higher education varies significantly based on the type of institution. Understanding these costs can be the first step in effective financial planning as a family. Below is a breakdown of the average college costs in Arizona for public, private, and 2-year colleges.

Image Source: Education Data Initiative

Public Universities

Public universities in Arizona, including Arizona State University, Northern Arizona University, and the University of Arizona, are generally more affordable than private institutions.

That said, costs can vary dramatically by school, so it’s critical to examine the specific costs of the schools you’re targeting when comparing different options. For example, The University of Arizona is the state's most expensive public 4-year institution, and in-state students can expect to pay $26,021 per year. But while that may be more expensive than some private universities in the state, it's about half the price of the most expensive private 4-year institution in the state—Embry-Riddle Aeronautical University: Prescott Campus—with a cost of attendance of $50,038 per year.

In addition, an essential factor to remember when considering Arizona public universities is the difference between in-state and out-of-state tuition. If you’re a resident of Arizona, you'll be eligible for in-state tuition, which is significantly lower than out-of-state tuition. This can be a major benefit to Arizona families.

Private Universities

Again, private universities tend to have higher tuition rates than their public counterparts. Private institutions like Grand Canyon University or Embry-Riddle Aeronautical University are examples. In addition, many private universities charge the same tuition for all students, regardless of in-state or out-of-state status.

Community Colleges

Community colleges in Arizona, like Maricopa Community Colleges or Pima Community College, provide two-year associate degree programs at a considerably lower cost than four-year universities. They can be an affordable and practical way to start a higher education journey.

Ultimately, understanding Arizona's diverse landscape of higher education costs—from public and private universities to community colleges—is essential for effective financial planning. With this foundational knowledge in hand, let’s explore different aid and scholarship options available.

Understanding Financial Aid and Scholarships

Navigating the mix of financial aid options can be overwhelming, but remember, you're not alone. Several types of aid are available to students, including federal aid, state-based aid, and institution-specific aid. With the correct information and strategic planning, these resources can significantly offset the cost of higher education.

Federal Aid

The U.S. Department of Education offers a variety of federal grants and loans to students. The Free Application for Federal Student Aid (FAFSA) is the most widely known form to consider. By completing the FAFSA, students become eligible for different types of federal aid in the form of grants, work-study funds, and loans.

State-Based Aid

In addition, Arizona offers some state-based aid programs to help students cover their higher education costs. These include a grant known as the Arizona Leveraging Educational Assistance Partnership (AzLEAP) and the Arizona Teacher Student Loan Program—a no-cost tuition and loan program for students wanting to become teachers. The requirements and benefits vary, so it's essential to review each program individually.

Institution-Specific Aid

Many institutions in Arizona provide their own financial aid packages. These can include scholarships, grants, or work-study programs. Be sure to explore the financial aid section of the institution's website or contact their financial aid office directly to understand the options and eligibility requirements.

How to Apply for Aid

The application process for financial aid generally begins with completing the FAFSA.

This form is used to determine eligibility for both federal and state aid. Many institutions also use the information from the FAFSA to determine eligibility for their aid packages. Remember to submit your FAFSA as early as possible, as some aid is awarded on a first-come, first-served basis. For institution-specific aid, additional application forms may be required. Always check the deadlines and submission requirements carefully.

Financial Planning Strategies to Consider

Ultimately, planning for higher education expenses requires strategic financial planning. Below are some strategies that can help Arizona families manage these costs effectively:

- 529 Plan

A 529 plan is a tax-advantaged college savings plan. Funds grow tax-free, and withdrawals are tax-free for qualified education expenses. It's less flexible than other investment accounts, but there are many options to choose from. Arizona residents can use any state's 529 plan and get a state tax deduction of up to $4,000 per beneficiary for married couples or $2,000 per beneficiary for single or head-of-household filers.

- Taxable Brokerage Account

Another strategy to meet higher education costs is investing in a regular brokerage account or other investment account. While this doesn’t come with the same tax advantages as a 529 plan, it has more flexibility when using the funds for things other than education expenses.

- Student Loans

Student loans are a common method of financing higher education, especially for those who can't meet the costs through savings or scholarships alone. Generally, federal student loans offer lower interest rates and more flexible repayment plans than private student loans. However, it's essential to understand the terms and conditions of any loan before accepting it.

- Tax Benefits for Education Costs

Lastly, there are several federal and Arizona-specific tax benefits that can help families offset the costs of higher education. These include the American Opportunity Tax Credit (AOTC), the Lifetime Learning Credit (LLC), and the Arizona College Savings Plan tax credit discussed above. These tax benefits can provide valuable savings, but it's essential to consult with a tax professional to understand eligibility.

Bottom Line

The path to financing higher education in Arizona is complex, encompassing a variety of options from public and private universities to community colleges. Tuition and associated expenses can be substantial, but families can leverage a mix of savings strategies, such as 529 plans and regular savings, alongside financial aid options like federal grants and Arizona-specific scholarships.

It's also worth considering the benefits of student loans, particularly those with lower interest rates and flexible repayment plans. Additionally, don't overlook the potential for tax benefits that can help offset education costs.

But in the end, it's vital to remember that every family's financial situation is unique. What works for one may not work for another, and that's where a trusted financial professional can help.

A trusted financial professional can help you make informed decisions, ensuring you're optimizing opportunities for aid, savings, and tax benefits, all within the context of your unique financial situation and goals. They'll guide you through the landscape of higher education costs, helping you secure your child's future while safeguarding your financial health.

So don’t navigate the journey alone—reach out today and take the first step toward financial success.